*This post was written by Kirk Wakefield – June 2017

Do you answer a call from an unknown number? Neither does anyone else.

Americans spend upwards of 4 hours a day on smartphones, but odds of answering an unidentified caller are about one in four. Millennials are even less likely to answer: Phone calls are seen as intrusive, impersonal, presumptive, time-consuming, and annoying.

According to Nielsen, Millennials spend more time on mobile devices than on TV. So, how do we reach them? We find them where they are and sell the way they like to buy.

Geo-Targeting: Raiders Case Study

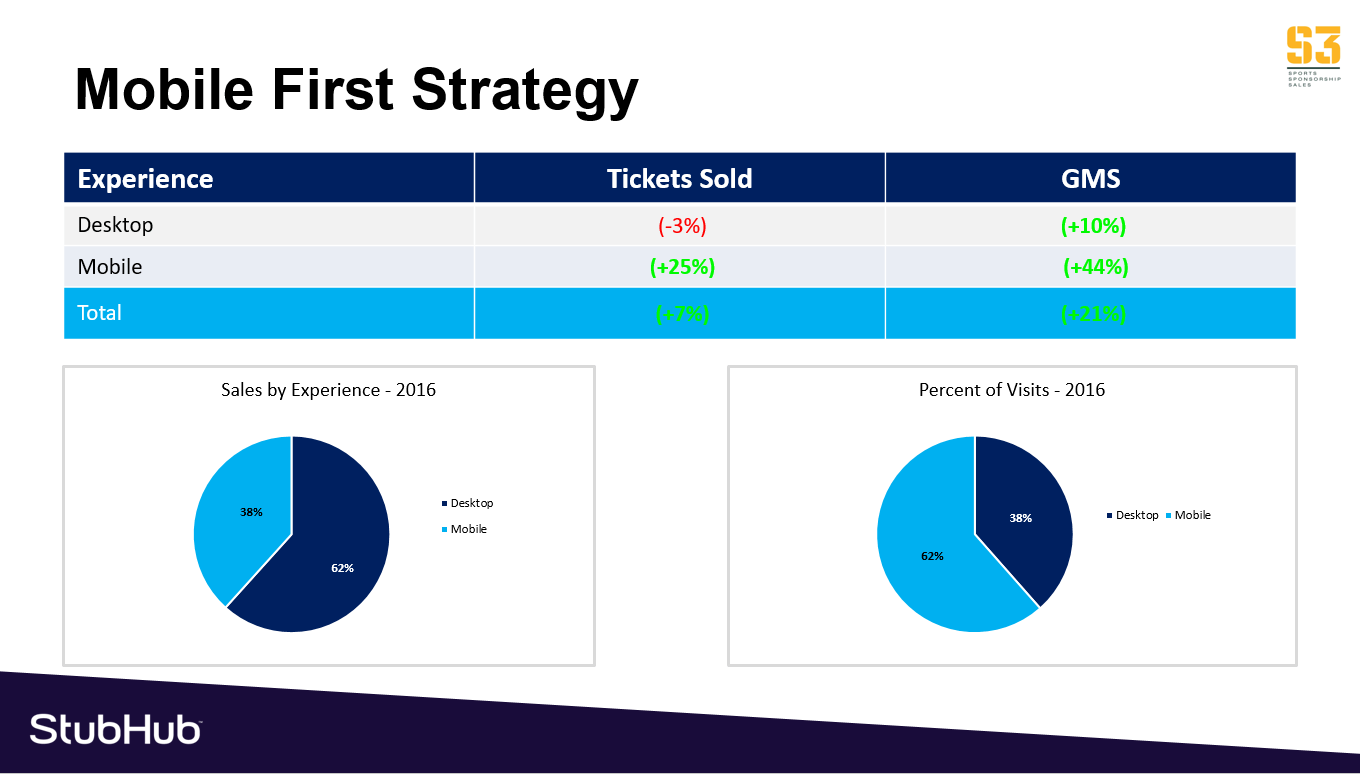

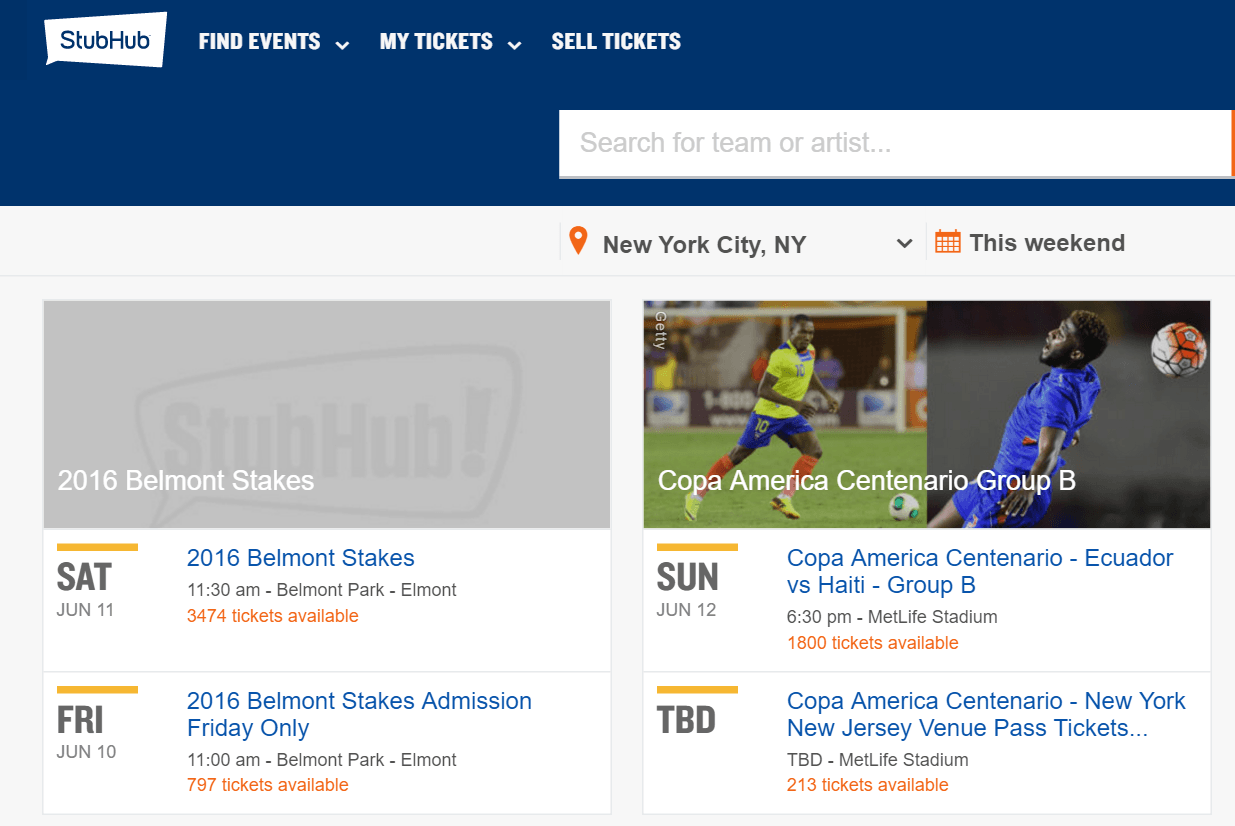

Where people come from influences how they buy–and how much they’ll pay and when. Working with our partners at StubHub, we find out-of-town fans are willing to pay significantly more, even as game time approaches. Below we see the difference in ticket prices paid for Raiders games in 2016, which is similar to other markets with respect to time and distance. Using geo-targeting, we can target campaigns (e.g., Google AdWords; emails) based on location.

Single-game buyers and, increasingly, multiple-game buyers prefer choosing individual games (vs. ticket plans) when they want to buy and when they want to go. Young consumers have always been variety-seekers. But, Nielsen reports all buyers are increasingly focusing on a wider variety of entertainment options than in the past. Buyers aren’t just thinking about your team (i.e., the Raiders). They may just as easily click on the next Groupon, social media offer, or Yelp recommendation.

Today’s ticket buyer is twice as likely to visit ticket websites (primary & secondary sources) than to directly contact the team. Younger buyers expect frictionless[ref]Read more about frictionless service here.[/ref] experiences. That’s why teams optimize for mobile sales and distribute tickets on secondary markets to take advantage of buyers where they are and how they want to buy.

What do buyers really want?

You need to know how seats are moving in the open market to appropriately set season ticket and individual game prices to maximize revenue.

Ticket distributors (e.g., Eventellect) and sellers (e.g., StubHub) help teams understand the dynamic nature of markets by analyzing what inventory sells through and at what prices. Sample data for an NCAA property (left) illustrates a typical pattern of average ticket prices (ATP) by seating area and the percentage of those tickets which sold (STR: Sell Thru Rate).

Buyers are less price sensitive for sports & entertainment events than for pretty much anything else. [ref]Wakefield & Inman (2003), “Situational price sensitivity: The role of consumption occasion, social context and income,” Journal of Retailing, Vol 79(4), 2003, 199-212.[/ref] Here, the highest priced premium seats ($900+) and the Field Club ($250) seats sell through well (75-80%). The lower STR (67%) for Stadium Club seats suggests needed adjustments to improve perceived value compared to the more or less expensive seats nearby. The high STR on New Alumni seats suggests the team could raise those prices, but may have overshot the mark on the Gold Zone seats. Without this data, this team would continue to leave money on the table or empty seats with inefficient pricing schedules.

The right side of the charts above show the hottest seat sections on the market for this team. If they offer inventory using dynamic pricing, share revenue with a consolidator, or (opaquely) distribute via a ticket provider like StubHub, they will capitalize on the high demand for specific sections (e.g., Benchback I and Gold Zones W and CC).

When should we release inventory and adjust prices?

Most individual game tickets sell during the week prior to the event. Well over a third sell in the last 72 hours. As the sample data shows below, advance ticket buyers are willing to pay more (ATP = $128) compared to those buying in the month leading up to the event (ATP = $72).

When should tickets be released for individual purchase? Earlier is better. Some teams hold tickets back to release close to game time. But, we can see this is not the best time to get the highest price. In a forthcoming journal article, we find that experienced sports & entertainment buyers have learned it’s better to wait to buy. But, if you want to sell high–like to out-of-town visitors and other infrequent, inexperienced buyers, supply needs to increase well in advance.

Conclusion

We’ve been analyzing retail pricing strategies for over 25 years. Pricing strategies in sports are quickly catching up with corporate practices, but much less is known about pricing intangible services than pricing tangible goods and products.

If you’d like to learn more about opportunities to analyze your ticket data or gain more insights, feel free to reach out to our friends at StubHub: Charlie Rockman, Nick Rudolph, and Adam Budelli. If your organization is interested in collaborating in our research center, please contact Kirk Wakefield.

San Diego’s Petco Park

San Diego’s Petco Park