by Kirk Wakefield – June 2016

Juniper Research classifies ticketing as one of the primary commerce applications driving eCommerce, estimating over one-fourth of ticket purchases will go mobile in the U.S. by 2020, and over half of ticket purchases outside of the US and Europe to be mobile-based by 2020. Teams like the Portland Trail Blazers renew season tickets via mobile devices and continue to see fans more comfortable in making both small and large transactions on mobile apps.

While we in the U.S. may think life moves at the speed of digital, we move at a snail’s pace compared to the growth in China, where the average consumer spends 45 hours online a week (10+ over global average). B2C e-commerce in China is expected to grow at a 30% clip from 2016-2020. As sports-related brands seek a global presence (like Barcelona and Real Madrid), teams and vendor partners must focus on engaging fans in the ways fans desire, rather than only what is expedient or profitable in the near term.

The quality of the consumer experience with the brand in online ticketing will determine the winners and losers as the world turns increasingly mobile. How do we know who’s winning? Who’s winning so far?

The BAV-S3 4V® Brand Index

The BrandAsset Valuator (BAV®) database is the largest and leading quantitative, empirical study of brands and consumers. Spanning 16 years, 51 countries, and over 680,000 respondents, BAV is the world’s largest database of brand perceptions; containing ratings on over 43,000 brands on 72 dimensions.

In collaboration with BAV, we developed the S3 4V ® Brand Index that evaluates online brands in terms of three positive dimensions of value, vision, and social vibe and one negative dimension of vanity. Customers favor online brands that demonstrate:

- Value: The leader, the best brand online characterized as (having)

- good value and worth more,

- trustworthy and reliable,

- simple and straightforward,

- high quality and high performance,

- original, authentic, down to earth and traditional

- Vision: The progressive, innovative, up-to-date, intelligent, visionary brand that is gaining in online popularity.

- Social Vibe: The brand that represents a fun, social, friendly, and charming online persona.

Customers discount or disfavor brands trying to score style-points without substance. Online visitors pick up on signs of Vanity, characterized as attempts to appeal to the upper class on the basis of glamour, style, prestige, sensuality, and trendiness. We find this has a negative effect on regular brand usage.

Together, these four dimensions explain over 50% of consumer usage of the brand. That amount of variance is another important V to consider as brand compete to win customers to their online real estate.

The Winners

The 4V Brand Index covers 278 brands that offer some form of online experience across a dozen sectors. Our index places weights on each of the four Vs in an equation that best predicts brand usage. Scores range from Amazon on the high end (29.02) to ISIS (-7.24) on the low end. Sectors include mobile phones, with iPhone and Samsung Galaxy outclassing all other comers by large margins. More interesting is competition among mobile payment vendors (Amazon Local Register vs. Apple Pay vs. Square), internet tools and services (Google Maps vs. MapQuest), or social media (how is Snapchat doing against Facebook, Twitter and LinkedIn?).

But, since we’re all about sports first, that’s where we will begin. The table may be sorted based on the overall index score or each of the 4Vs.

[table id=4 /]

Ticket sellers

Although tickets are only a part of their businesses, eBay and Groupon lead the way in offering online experiences that customers perceive as offering value, vision, and vibe that outweigh attempts to appeal to the vanity of buyers. Given shopper motives for buying online, the strongest predictor of brand usage in our equation is value, followed by brand vision.

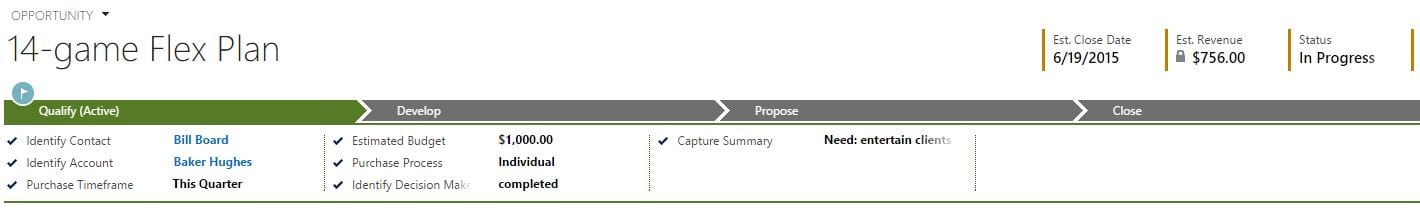

Between the two leaders in ticket sales online, eBay’s subsidiary, StubHub (8.56) performs better than Ticketmaster (7.13), primarily due to vision (13.29 vs. 10.52) and social vibe (12.61 vs. 10.54) customers get when they visit their websites or use their mobile apps.

In the future, we will add SeatGeek and VividSeats to the index, two ticket sellers with significant investments in online and mobile ticket distribution.

The Losers

Fan Duel and Draft Kings suffer from high vanity scores and low value scores. Being new and on the cutting edge (vision) helps attract customers, but a brand’s longevity is in question if it cannot deliver value.

On a broader scale, sports teams must be mindful of partnering with online brands with negative personas. The two lowest rated online brands (ISIS and Al Jazerra) clearly aren’t potential partners, but not far behind are Foursquare (4V = .13) and Tinder (4V = .18). Granted, these might target specific fan segments, but the signal sent to all customers may not bode well for the team and its other brand partners. Brands with relatively low 4V scores may be due to overall low market strength and penetration. Customers don’t necessarily hold negative perceptions, but may hold no perceptions at all about the brand.

Looking forward

In future analyses, we will take a closer look at ticket sellers to examine the specific features and drivers of customer online experiences.

[/dropshadowbox]asking your sales team what incentives they desire most, you’re accomplishing two things:

[/dropshadowbox]asking your sales team what incentives they desire most, you’re accomplishing two things: