by Kirk Wakefield – May 2017

In a league of its own

StubHub sells a ticket at least once every second. Over 21 million unique highly qualified buyers visit StubHub every month. Last year (2016), StubHub sold over $4.2 billion in tickets. That total essentially places StubHub in a league by itself, comparable to the NBA or Premiere League and more than the total revenues of the NHL, Bundesliga or La Liga.

Thanks to our S3 partnership with StubHub and Geoff Lester, our friends Charlie Rockman and Nick Rudolf presented breaking insights at our annual S3 Board Meeting in January, 2017.

In this article we present three of these insights related to demographics, search habits and mobile use in ticket purchase. Next month we will follow with insights on geo-targeting, conversion to ticket plan buyers, and inventory management given the timing of purchase behavior.

Demographics of online ticket buyers

![]() Knowing half the females in the DFW metroplex are Dallas Cowboys fans, the Cowboys launched www.5pointsblue.com to offer content written by female staff members. The content appeals to the female fan base, but a broader audience as well, generating 350,000+ monthly visits. Other properties would do well to emulate the initiative to serve its entire fan base in a way that meets needs and preferences.

Knowing half the females in the DFW metroplex are Dallas Cowboys fans, the Cowboys launched www.5pointsblue.com to offer content written by female staff members. The content appeals to the female fan base, but a broader audience as well, generating 350,000+ monthly visits. Other properties would do well to emulate the initiative to serve its entire fan base in a way that meets needs and preferences.

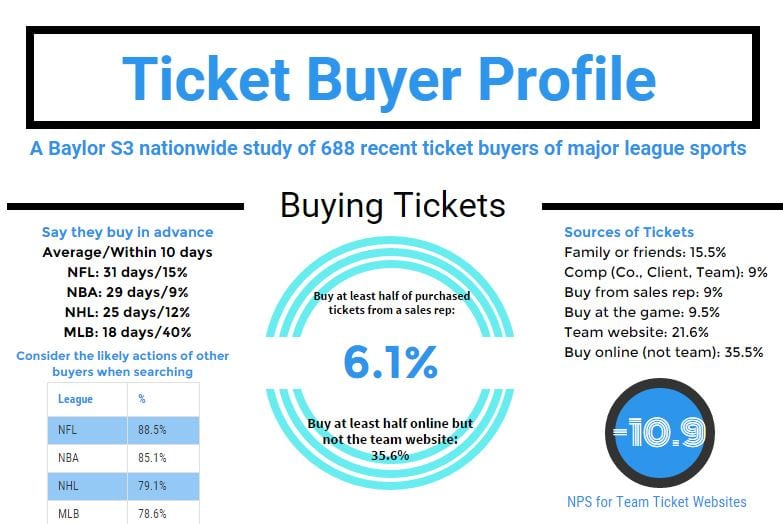

As seen below, we see a slight shift in females buying online (43%), but more importantly the Average Order Value (AOV) increased among first time female buyers versus first time male buyers. As millennials overtook baby boomers as the largest generation this past year, so has the percentage of younger buyers. These young buyers may see concerts and other events as viable entertainment options to sports. Commensurately, we see more lower-income first-time buyers–who will be tomorrow’s potential season ticket holders. The question is: How are teams serving the buying needs of this younger segment that will translate into future ticket buying fans?

Ticket Search: Event, Team or Date?

Knowing how people search is one of the keys to successful Google AdWords campaigns. Which of these is most likely to show up in a relevant search?

- Event (Cavs vs. Rockets)

- Team (e.g., Cleveland Cavaliers) or artist (Justin Timberlake)

- Date (Friday, December 1, 2017)

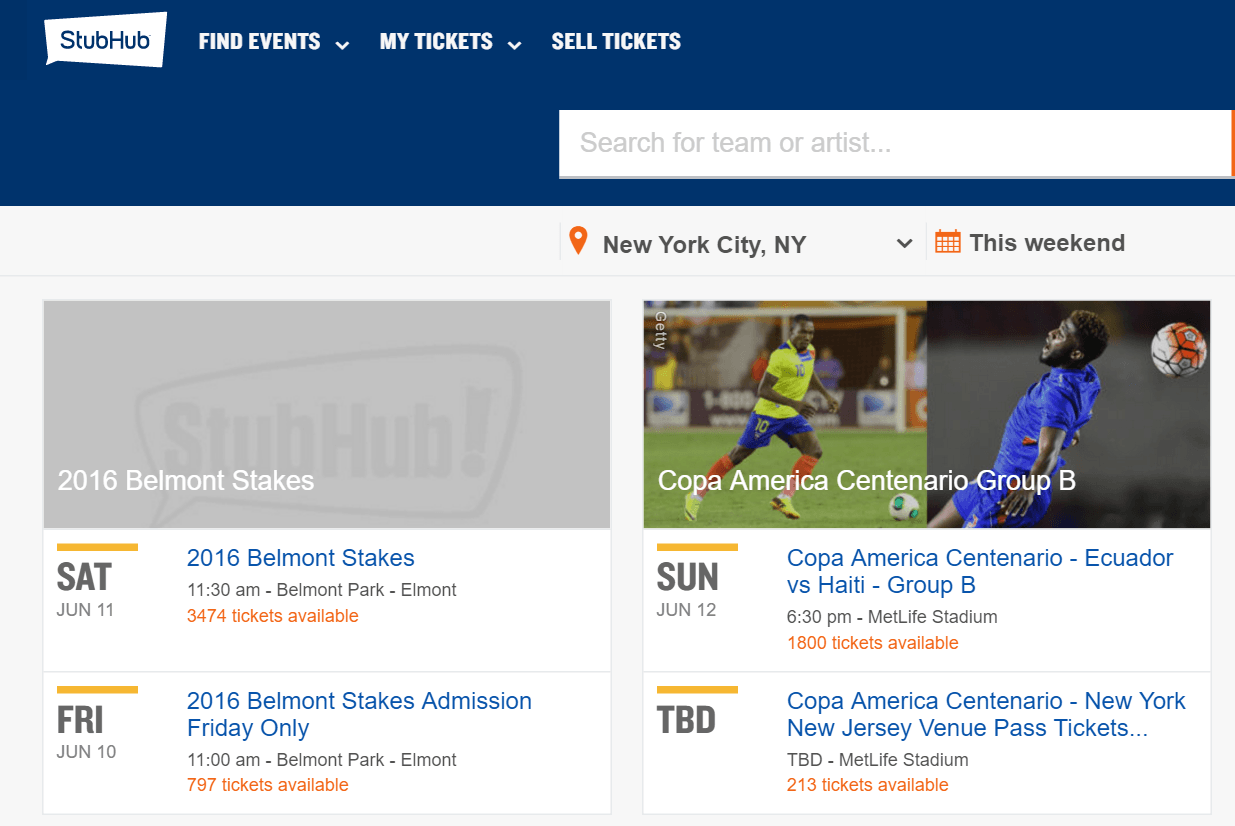

We might think new buyers typically want to see a specific event on a certain date. We would be wrong. Instead, buyers increasingly and foremost search for the team or artist, rather than having a specific event or date in mind. Furthermore, last minute purchases (33%) and on-the-go (not at home/office) are the major reasons for purchasing via mobile. So, if we want to reach people where they are–with phones in hand–we best be mobile and search-engine optimized for quick access.

Mobile First Strategy

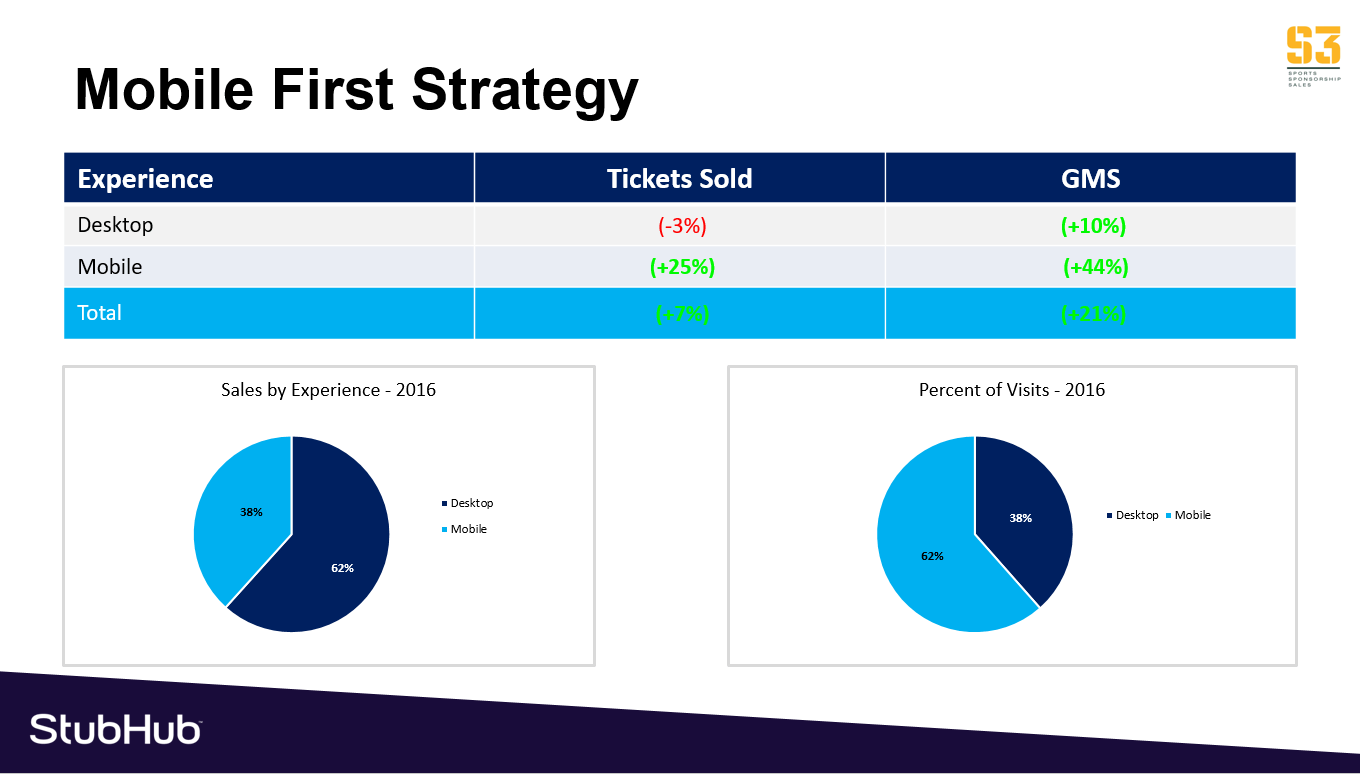

In 2014, 41% of traffic and 20% of sales came via mobile for StubHub. Just two years later, 60% of traffic and 42% of sales came via mobile. In general, revenue from 2015 to 2016 is increasing via online purchases, but disproportionately via mobile in terms of tickets sold (+25%) and total sales (+44%) compared to tickets sold via desktop (-3%) and total sales (+10%). (See graphic at the top of this article.)

Expect the trend toward mobile to continue. In the past the majority of time spent on mobile was searching, but most purchases of goods and services were made on desktops. But, as StubHub and others with native apps improve the mobile experience, more will shift to mobile purchases. As seen below, the majority of purchases are still on desktops, but more bought via mobile devices and native apps in 2016 than 2015. The most mobile-friendly buyers are football (NCAA & NFL) fans, but the growth in mobile purchases will extend across leagues.

Conclusion

In short, the takeaway insights are:

- Target females the way they consume content and make purchases.

- Manage search engine campaigns aimed at team/artist searches, more so than event or date.

- Optimize for mobile ticket purchases. If your mobile sales are not growing at the same rate as the market, you are not mobile optimized.

When do people buy? And what happens to average ticket price over time? We know over one-third now wait until the last 72 hours to purchase. To learn more, come back for next month’s release.