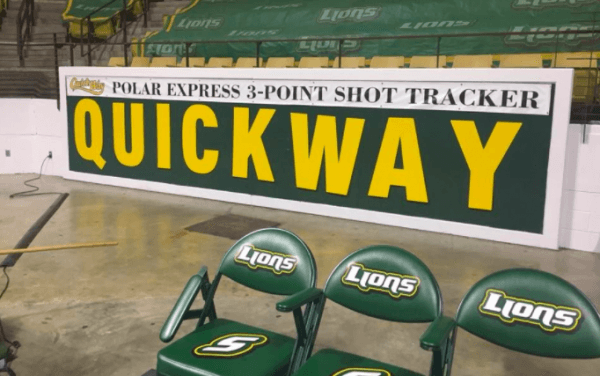

by Itzayana Aguirre – February 2018 Sponsorship Shorts: QUICKWAY Wesley Abercrombie (S3, 2017), the General Manager for Partnership Sales at Southeastern Louisiana University Athletics, shared this creative partnership activation strategy: If the basketball team makes eight 3-point shots, everyone at the game wins a free slushie from our local convenience store partner, Quickway. We keep track…Continue Reading Want a QUICKWAY for a great activation strategy?

Want a QUICKWAY for a great activation strategy?